Forging BNPL future

Leanpay is a pioneer of Buy Now Pay Later 3.0. We believe that the future of BNPL is: i) to be a regulated company, ii) to be a responsible lender, and iii) to finance purchases of any size with fairly priced loans.

Evolution of Buy Now Pay Later

BNPL 2.0 showed that consumers need a fully-digital financing solution at the checkout. However, due to soft credit check policies, consumers are becoming over-indebted, and inflation is making the price of 0%APR loans for merchants unbearable. It is time for BNPL 3.0!

BNPL 1.0

Banks provide POS loans at checkout in pre-BNPL era:

- Non-digital solutions

- 24h* decision time

- Larger purchases (furniture, more expensive consumer electronics, etc.)

BNPL 2.0

Fintech companies enable consumers to pay in 3 or 4 installments with 0 costs:

- Fully digital solutions

- Soft-credit check

- Non-regulated

- Smaller purchases (fashion, less expensive consumer electronics)

Bnpl 3.0

Enable consumers to pay for the purchase of any size in 24 & more fairly priced installments

- Responsible lender (deep credit & DTI check)

- Regulated company

- Digital process & Omnichannel

- Fairly priced loans

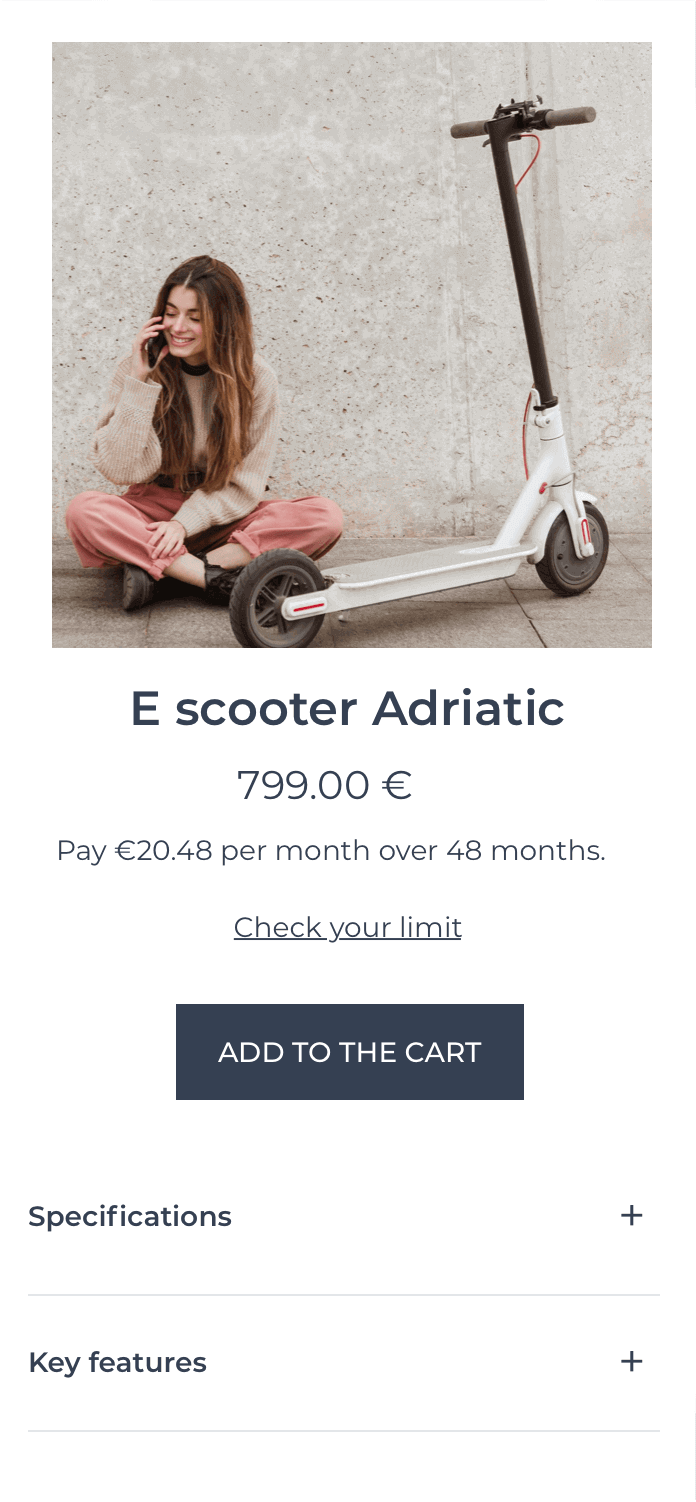

Leanpay is bringing the BNPL experience to purchases of all sizes

Bnpl 1.0

Bnpl 2.0

Bnpl 3.0

500 €

5000 €

Purchase amount

Featured in:

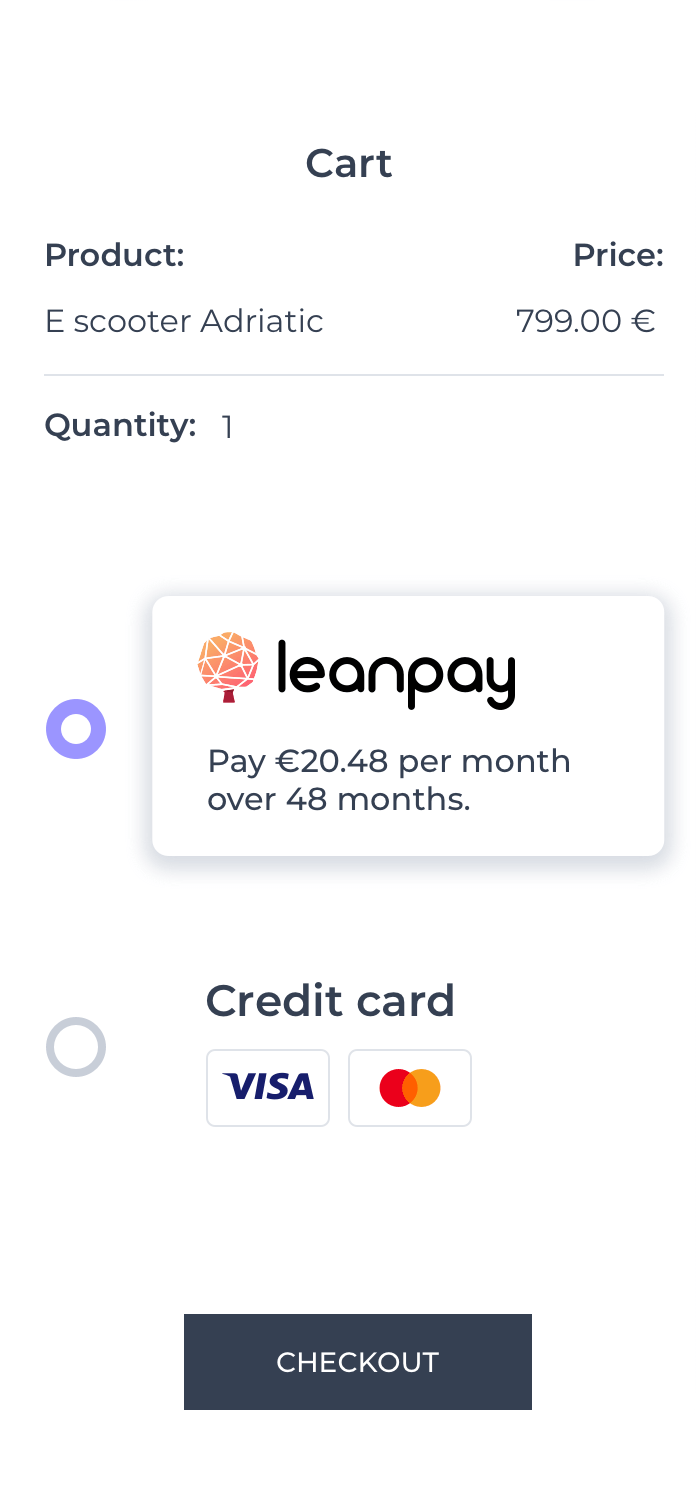

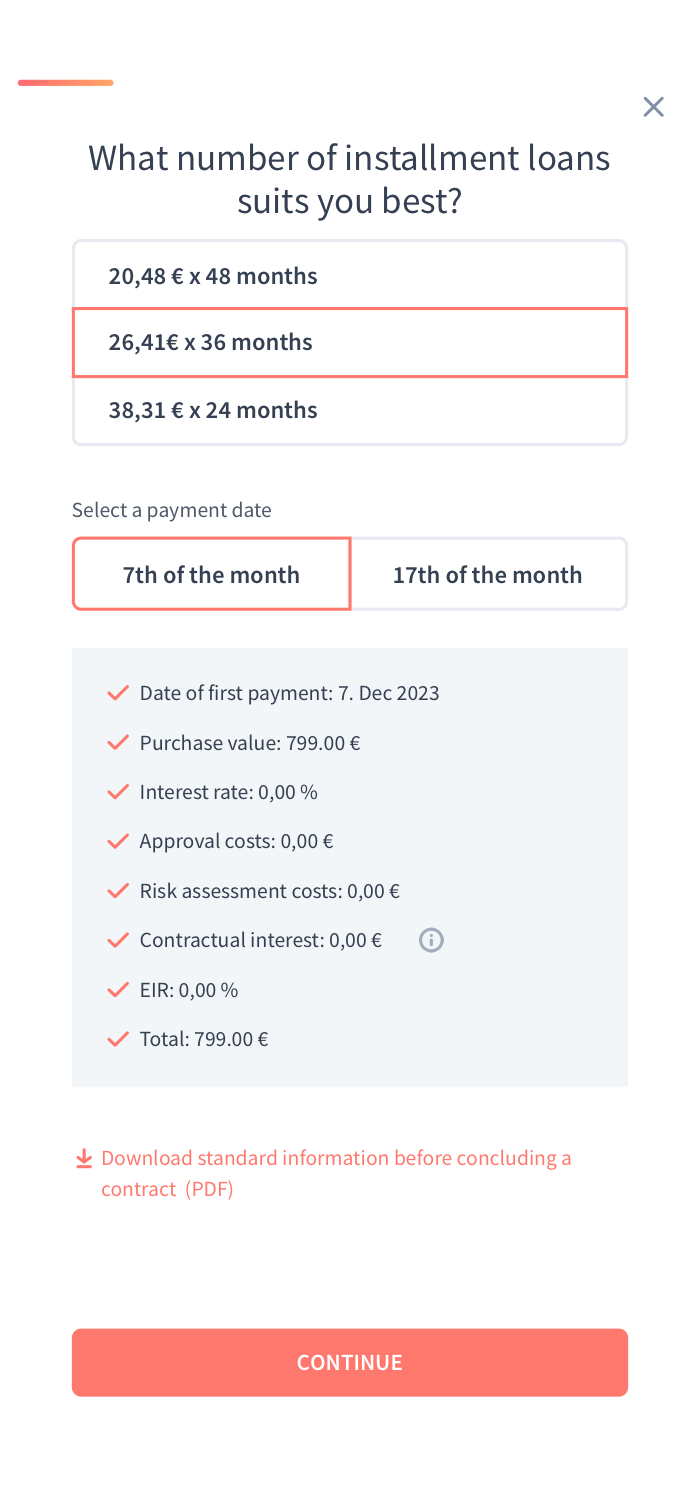

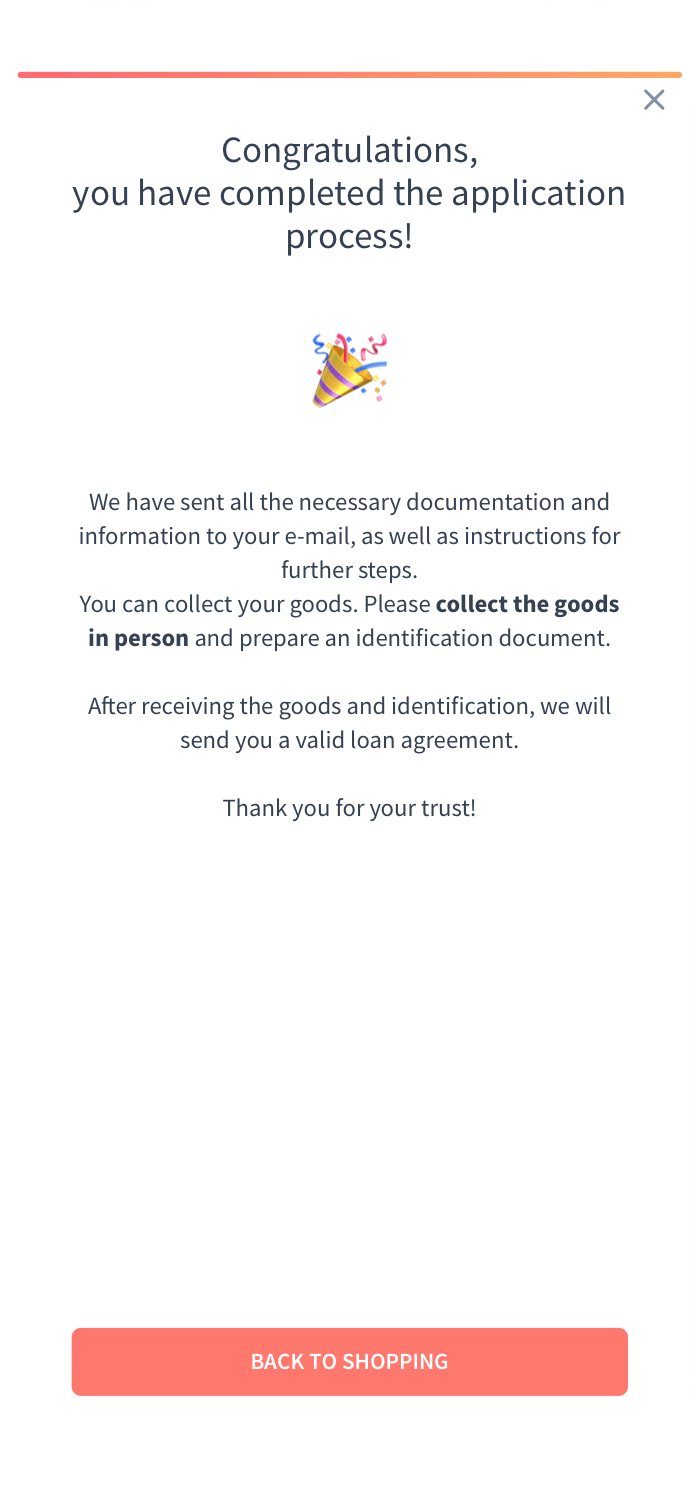

Empowering shoppers to buy responsibly

- Digital first: shoppers can apply online

- Shoppers get decision in minutes

- Completely transparent costs

- Shopping both online and offline

- Shoppers manage their spending in Leanpay app

- Financing purchases up to 12.000 EUR and split it up to 60 installments

Accelerating merchant partners revenue

- Omnichannel solution for both online and brick & mortar shops

- Proven to increase overall sales and boost average order value

- Dedicated support and resources for merchants enabling them success

- Seamless integration suitable for family run shops or international conglomerates

- One stop shop for financing purchases of any size up to 12.000 EUR

Leanpay in numbers

€

average order online

€

average order in-store

average number of instalments

%

cost of risk

k

users

m€

loans issued

merchants

%

retention rate

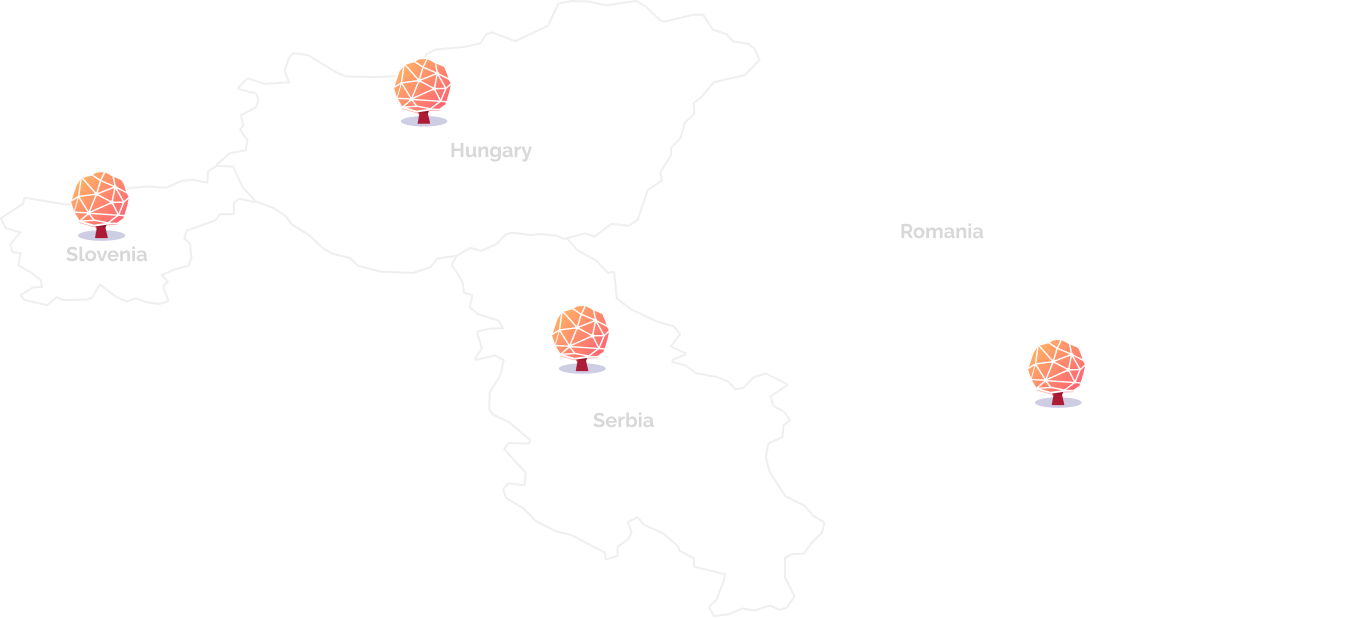

Expanding in South & Eastern Europe

2017

Formed

Product MVP launched

Raised pre-seed funding

2018

July: achieved Slovenian credit license & Market launch

2019

Raised x via South Central Ventures

Raised seed funding

2020

Feb: Full member of SISBON

200 active merchant partners

Users made 12M worth of purchases

2021

Extended to purchases up to 5k in 48 installments

Raised series A investment

2022

Launched in Romania

Sept: licenced by NBR (Banca Nationala a Romaniei)

2023

Launched in Hungary

Aug: member of KHR (Hungarian Central Credit Information System)

2024

July: Raised €10M Series B investment

More than 200M consumer loans issued

Over 120k satisfied customers

Management team

Get in touch

Do you want to learn more about Leanpay? Send us your message and we will get back to you!

contact@leanpay.com